EXCERPT

Issuing bonds is a common way that countries, banks, and corporations raise money for themselves. Bonds are a type of loan that functions like an IOU. When an investor purchases a bond, they are lending money to a borrower that is eventually paid back in full when the bond reaches “maturity.” Bondholders receive interest payments over the course of the life of the bond. When an investor purchases bonds from Israel Bonds, they are loaning money to the Israeli government to use at its discretion.

In 1951, Israeli Prime Minister David Ben-Gurion launched Israel Bonds at Madison Square Garden with the goal of engaging Diaspora Jews to fund the State of Israel. Today, Israel Bond purchasers are encouraged to see their investment not just as a way to diversify their investment portfolio but also as a declaration of their commitment to Israel and Zionism. Israel Bonds also encourages investors to see Israel Bonds purchases as a “rejection of BDS advocates claims, proposals and objectives,” referring to the Boycott, Divestment, Sanctions (BDS) movement, launched in 2005 by Palestinian civil society groups which aims to “end international support for Israel’s oppression of Palestinians and pressure Israel to comply with international law.”

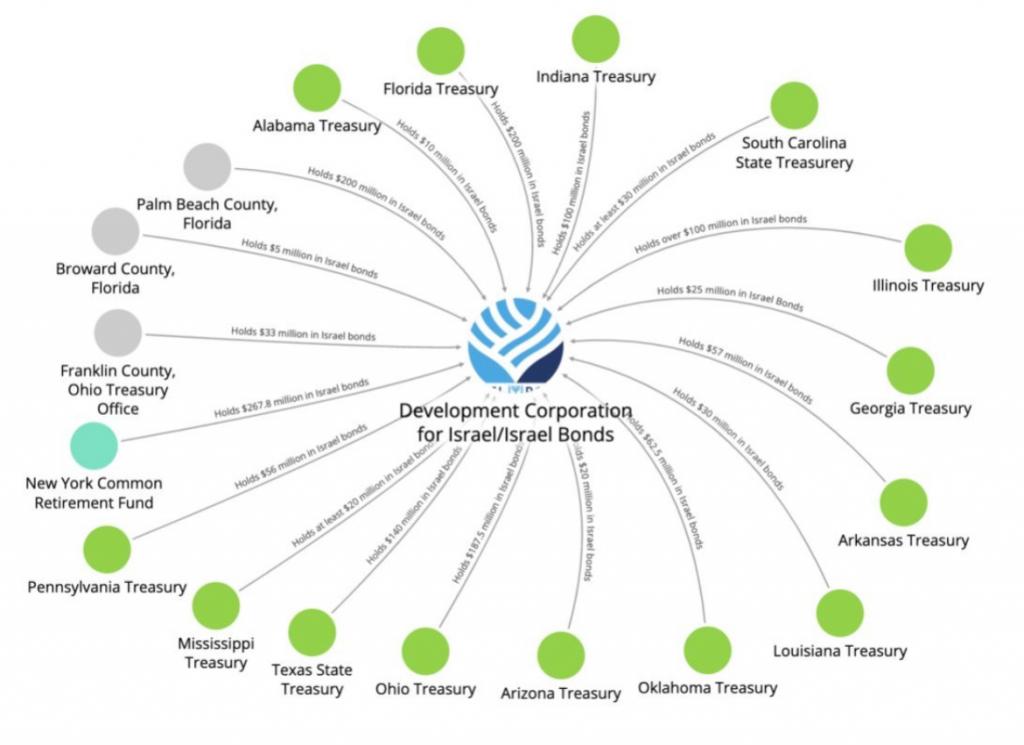

Israel Bonds, a U.S.-registered entity that operates like a brokerage firm connected to Israel’s finance ministry, serves as the U.S. underwriter for debt issued by the State of Israel, and has been selling bonds in the U.S. since 1951. In July 2023, CEO Dani Nahveh stated that Israel Bonds had achieved $49 billion in worldwide sales since they began selling bonds. U.S. investors in Israel Bonds include state and municipal pension funds, treasury funds, corporations, insurance companies, associations, unions, banks, financial institutions, universities, foundations, individuals, and synagogues. According to SEC filings submitted by the State of Israel, published on Israel Bonds’ website, as of December 31st 2022, Israel Bonds had $5.4 billion dollars in outstanding bonds and notes amounting to 12% of Israel’s external debt.

Source:

https://littlesis.org/news/u-s-state-and-local-treasuries-hold-at-least-1-6-billion-in-israel-bonds/